As a busy professional, I do not have time to write an eBook, or create a video course, does that mean I or you cannot earn a passive income stream? We absolutely can. In this post, I will show you how I am building my completely passive income stream. Passive means, I do not have put much time on it.

How A Busy Professional Can Earn A Passive Income? We can invest our money in an income-producing asset, even if do not have enough money for a down payment of a rental property, we can still get started with little money in high yield money market account, real estate, and income-producing stocks.

Betterment, WealthSimple are Robo advisors, which can set your investing on autopilot, and they offer you money market options which offer around 2% interest on your savings, and there is no high limit like money market accounts offered by Banks. And they offer you different options to invest in Equity and Bond ETF based portfolios on their platform for a little fee. You pay for the convenience.

Do you earn Dividend on Robo Advisor accounts?

The equity and bond ETFs you own, pay dividends couple of times every year. Those dividends automatically get reinvested. I believe the only way to withdraw that amount would be to partially liquidate your investment. The dividend you earn reflects on a statement they provide you at the end of the year, that you would need to file tax.

Peer Lending as Second Passive Income Source

Lending Tree and Prosper are 2 peer lending platforms that I have used. The return has been better than any bond or Money market account. Check the screenshots below. One important point, I am risk-averse, I always invested in A and AA rated notes. But you can choose any note you wish to, based on your risk appetite. One more point on the same note, I have witnessed delinquency even after investing in A and AA notes.

Every month, you get some interest and part of what you lent back. So, if you do not continue investing in new notes, your capital will deplete with time. The notes are for 3 years or 5 years, so you need to wait until at least 3 years before the note matures. So, do not commit any money that you might need before the notes mature.

And if you want to liquidate before 3 years, these sites have a marketplace where you can go and sell the notes, but you get paid less than you would have gotten otherwise. So, liquidity is a matter of concern on these platforms.

Regarding tax – these sites send you tax statement by mid-January to February. You can just give those to you accountant while filing tax.

Here is the third source of passive income –

the third one is real estate. There are 2 options, first one, you just need $500 to start, and the second one is a platform to buy rental properties. First one is Fundrise. I have some money invested in this portal. Liquidity is a huge problem when it comes to real estate. So, do not put any money in real estate that you might need in the next 5 years. Here is a great review of Fundrise.

The dividend you earn from Fundrise is taxed at your income tax rate.

The second option is Roofstock. You get to see a ton of income/rental properties. You would get $500 for signing up. There is again a great review for Roofstock, that can be found here.

I am yet to buy a property on this platform, but you can look up on youtube, a lot of people had good experiences with this site.

The fourth source of Passive Income –

There are financial instruments listed on exchanges that can be considered as passive income sources.

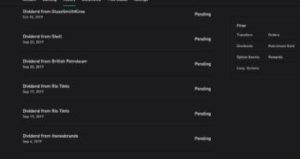

Common Stocks – If you can buy stocks such as ATTT, Verizon or BP, these stocks have great dividend yield. You get a dividend every quarter. I buy such stocks using Robinhood since there is no commission while buying or selling stocks.

Other than common stocks, you can consider REITs, MLPs, Muni Bonds, preferred stocks, ETFs and other bonds. All these instruments can generate steady dividend flow which will a good way to earn a passive income.

Muni bonds are a great option to earn a passive income, as the interest you get is tax-free.

Bonds pay you a steady flow of coupon payments, but in long term bonds are not good at beating inflation.

Preferred stocks are equity instruments but pay a fixed coupon like bonds with no upside. Wells Fargo has a listed ETF for preferred stocks that you can check out.

REITs are real estate investment trusts, they control a portfolio of commercial, residential properties, and whatever they get as income, 90% of it they pay to shareholders.

MLP means Master Limited Partnerships. MLP has 2 types of partners, unitholder, whoever own the units and general partners, whoever runs the partnership. MLPs are mainly found in oil and gas or natural resources center, these are long term in nature. But, usually, these have high debt and minimum upside. And MLPs are heavily affected by commodity price swings.

Partnerships distribute the earning among unitholders, so at the year-end, you will get a K-1, and filing tax would cost you more just because of this K-1, as it contains earning, depreciation, etc. Even if you put MLP in IRA, still there are tax implications, verify this with your tax advisor.

I personally do not own any MLP, neither do I plan to. I actually prefer REIT and some commodity stocks which pay a high yield. These are the main passive income sources I have and you can follow the same stretegy to earn a passive income. Now let us quickly check what is a qualified dividend and what is a nonqualified dividend.

RELATED QUESTIONS

When Are Dividends Taxed?

Companies are usually taxed and as they payout part of of their cash flow to the shareholders, shareholders pay tax on that dividend income. IF the dividend on the common stock is qualified then the tax rate is less than the ordinary income tax rate. Your broker will send you a dividend form/1099-DIV indicating how much is qualified and how much is nonqualified dividend income for the previous financial year, and you can file your tax including that dividend statement.

What Dividends Are Taxable?

If it is not in an IRA then in most cases dividend from common equity share, MLP, REITs, bonds ( excluding muni bonds or any other tax-free bonds), dividend from preferred stocks are taxable. But the tax rate on dividend varies based on if the dividend was qualified or nonqualified.

What is the advantage of qualified Dividends?

Qualified dividends are great for investors as these are taxable federally at the capital gains rate, which depends on the investor’s modified adjusted gross income and taxable income and the rates are 0%, 15%, 18.8%, and 23.8%.

Nonqualified dividends can be taxed at an ordinary rate which can be as high as 37%.

What Qualifies As A Qualified Dividend?

Here are the factors that qualify a dividend as a qualified dividend-

- Source of the dividend, should be common stock ( of domestic or certain foreign companies)

- You need to hold those shares of stock unhedged for at least 61 days out of the 121-day period that began 60 days before the ex-dividend date. That means you cannot sell a call on those shares or pledge to any other option activity.

- Rules are a bit different for certain preferred stocks, you must hold those for 91 days out of the 181-day period beginning 90 days before the ex-dividend date.

- The rules are almost the same when comes to dividend from equity mutual fund, but please do your own research, here is a great resource to start with – https://www.fidelity.com/tax-information/tax-topics/qualified-dividends

Examples of Qualified Dividends

For example, your Form 1099-DIV indicated dividends as qualified from shares in XYZ fund. You purchased 10,00 shares of XYZ fund on April 26 of the tax year. You sold 2,00 of those shares on June 14, but continue to hold (unhedged at all times) the remaining 8,00 shares. The ex-dividend date for XYZ fund was May 1.

Therefore, during the 121-day window, you continued to own 2,00 shares for 49 days (from April 27 through June 14) and 8,00 shares for at least 61 days (from April 27 through July 1).

The dividend income from the 2,00 shares held 49 days would not be qualified dividend income. The dividend income from the 8,00 shares held at least 61 days should be qualified dividend income.

What Determines If a Dividend Is Qualified or Nonqualified?

I have already answered it above. In short, the security type and holding period, provided you do not have a put, call or short sell associated with those stocks.

What Are Non-Qualified Dividends?

Any dividend you earn from Master Limited Partnerships, REITs, or from stocks held for less than 60 days would be nonqualified. And to summarize, check the criteria above, anything that does not comply with those would be nonqualified dividends.

How to Find out from 1099-DIV if a dividend was qualified?

At the end of a financial year, most probably in January or February, the broker(in my case Robinhood) will send you 1099-DIV form. Qualified dividends are reported on Form 1099-DIV in line 1b or column 1b.

Heya i’m for the first time here. I came across this board and I find It really useful & it helped

me out a lot. I hope to give something back and aid others

like you helped me.