I will use Coke to explain the Forward Annual Dividend Yield, and we will discuss other possibilities. I hold Coke because I know the business and whoever heard about Warren Buffet, probably knows that KO is one of his favorite businesses.

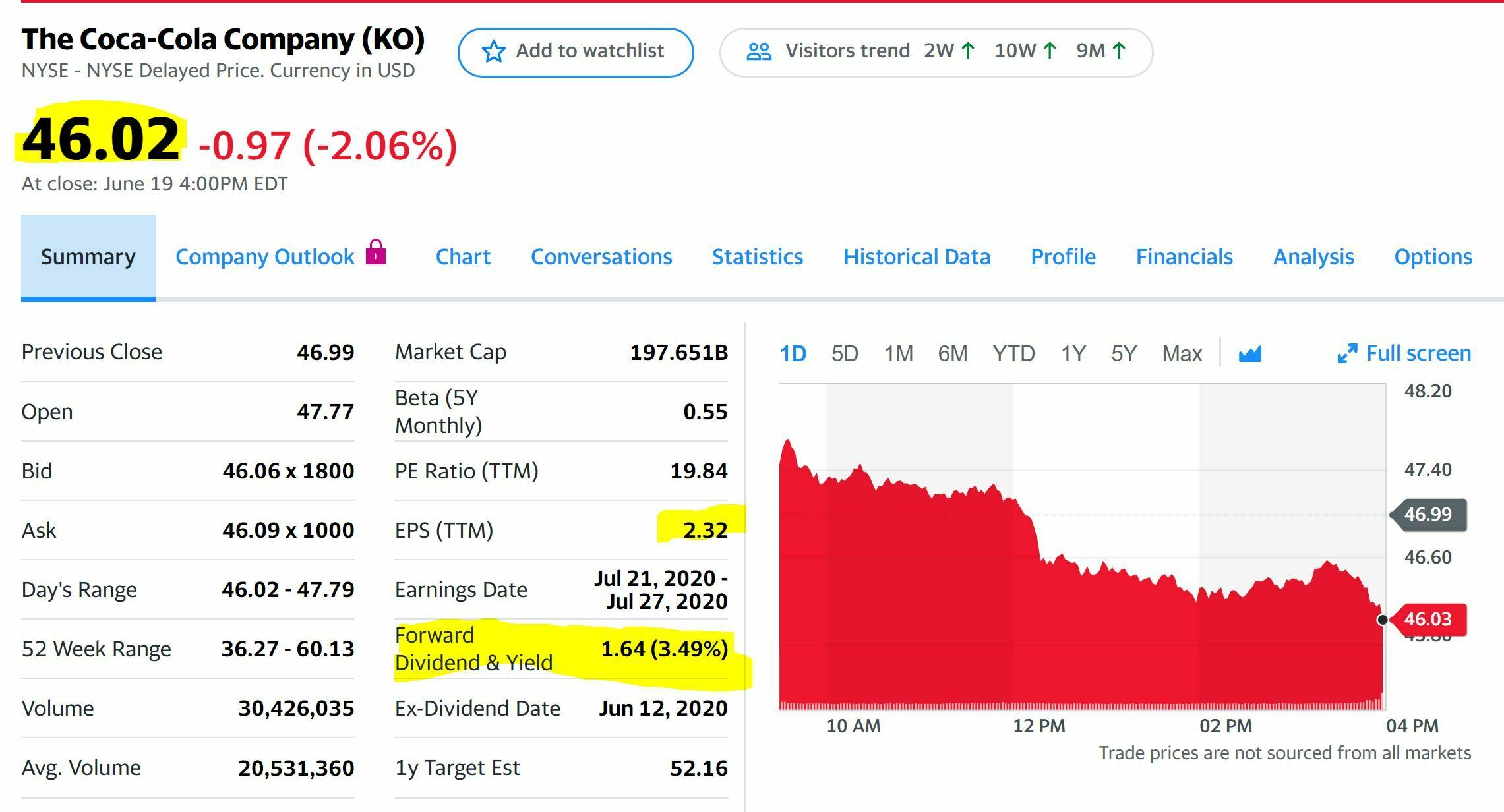

So this is a screenshot from Yahoo Finance. You can get all this information too, for free. Now, what is the Forward Annual Dividend Yield? At the current cost, which is on 21st June 2020 is $46.02, The Coca Cola Company(KO) is expected to pay out $1.64 as a dividend, which means the dividend yield at the current price is 3.49%. You can find out when the yield will increase here.

Before you think Ko is as good as they get and the dividend is rock solid, I would like to give you a few facts to ponder up on.

Coca Cola has earned $2.32 per share last financial year, given the situation we are in, which is the pandemic. Restaurants are not allowing sit down meals, which means less sale of beverages. People are losing income, being furloughed, or taking a pay cut, the question is, will that mean that Coca Cola will sell fewer beverages around the globe? We do not know yet. We will find out soon. But, if earning drops significantly, then paying dividends from reduced profit might get a bit tricky. Ko’s payout ratio can tell us if we should expect a dividend cut or not.

Now, if the outlook is not so stable, why the stock price is so high?

The stock market and economy are 2 different things. In the long term, they move in the same direction. But in the short term, the stock market is forward-looking and the economy is backward-looking. Like unemployment is going up, but we know that fact based on the data which came from the past few weeks.

Moreover, you have to consider following, most analysts value a stock by calculating the net present value of future income of a company, given that the money is available for free, there is almost next to a nothing hurdle rate, bonds or CDs, which are considered as risk-free investments are not paying you anything. And Fed has a printing press that is working fast that the speed of light, people see the stocks to preserve their purchasing power better than just holding cash in the bank.

I am not saying Forward Annual Dividend Yield for KO is in danger, all I am saying that we do not know enough to conclude anything. Although the stock price may go up, the price to earning ratio might expand. But dividend will depend on the earning/profit. That is why companies like Royal Dutch Shell decided to cut dividend, given the lower crude price, they know, they would not earn enough to pay the dividend.