I am an ITC shareholder. And I have been increasing my holding for the last 3 years. On 26th June 2020, ITC declared a 10.15 rs dividend for the year 2019-2020. And I noticed there was a group of cheerleaders who came into action. ITC proudly declared that their PAT has grown etc. I do realize there is a fan base of this stock. They think the business is undervalued. Personally I am in that camp too, at least so far. But the fact of the matter is, the stock price is going one way, that is towards the south.

I thought I would jot down the things which may go wrong in ITC and few factors which may stop those things from going wrong, anyway, let’s discuss.

ITC’s major profit comes from tobacco products, and the market seems to hate it. Tobacco companies are not ESG compliant, hence tobacco companies all around the world have taken a beating. And ITC does not offer any smokeless device or electronics device as Juuls does. Those vaping devices could attract kids as customers and may be higher multiples. Although I am glad that ITC is working hard to move away from tobacco. But the question is, when will the FMCG division make any money?

After this COVID situation, nobody knows when tourism will be back, and when will the hotels see some guests? I am guessing, if we get a vaccine by the end of this year, I would expect most people who can afford the vaccine to be vaccinated in another year. So, tourism should start picking up by the end of 2021. But until then, that will be a cash-burning division. Although, tying up with Swiggy and Zomato was a good idea if they can execute to keep the ITC kitchens running. I am yet to visit one personally, but I have good feedback.

The packaging seems to be interesting. They can pack their own stuff and supply to others. Downside? Cannot think of any, at this moment.

Notebooks and classmate brands might get into trouble, if most of the studies and school work move online, classmates will become irrelevant.

The Retail division they have, I cannot even remember the name, Wills maybe? It sucks. It is expensive and stupid. I think ITC should sell it off while they can, if not, then just shut it down.

The agriculture business might actually flourish. As long as they do not stick around in West Bengal. With the new law and introduction of contract farming, I think they might find opportunities like organic farming. Then do realize that agriculture is mostly a commodity business, and food processing does add value, but given Indians very low production yield, it remains to be seen, what kind of margin and volume ITC can generate in the future.

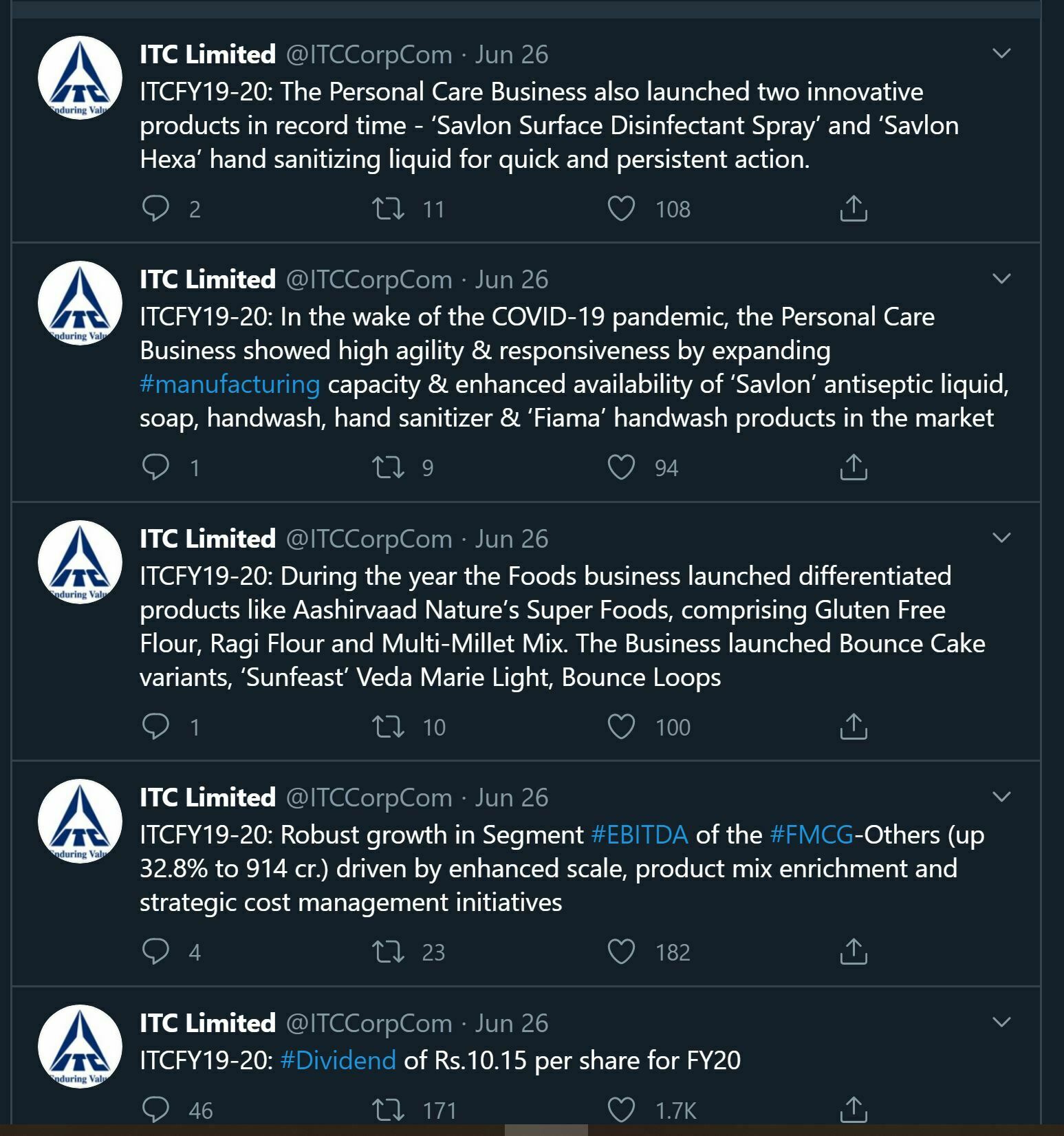

LEt us talk about FMCG. When margin and profit seems to be some words which are yet to be introduced. While they have Tata Consumer, Haldiram, and thousand other brands as major competitor, but I see this business to have potential. I have personally tried all their products, and got feedback from friends and family, everyone like those products. But….the PROBLEM is, these are hard to find. Most products exist in ITC’s annual report and not in your Kirana store or super market shelves. I see this to be a massive problem. But this is fixable. But, another challenge is all super markets have introduced their own brands, including Amazon ( they have vedaka). The same trend is in USA. I worry that ITC might miss the boat.

Then again, we have huge population. And this year when I took a road trip and visited less populated districts in bengal, I noticed they do have local brands mostly in the neighbourhood kirana stores. I see this to be a huge opportunity for all major FMCG companies. Because I believe in this covid times, many of these small businesses might go under, even if they don’t big companies may eventually gobble them up.

And ITC did a good thing by partnering up with Amway, they should push their stuff thru any possible channel. Now, the question is is this stock undervalued? I honestly do not think, ITC has rock solid moat around the business, Although they are working towards building an ecosystem, where they produce their own raw material and then add value and sell, mostly in processed food segment. And they have grown some good brands too, we cannot deny. And given the quality of their goods, I believe those brand values will grow. But, then will ITC be able to sustain the moat or build on it? Remains to be seen. And market is not convinced. I can tell you one thing, I do not intend to sell this business in financial year 2020. In fact I might add some more shares.