In India, I do not know how many people invest for the long term. Some people did, mostly after the bull run in 2017, many people were drawn towards mutual funds, but 2020 has shown everyone that Mutual fund Sahi nehi hain. And the ad was a total sham. Dividend Earnings In India is possible, you just need to know how to select the correct stock.

Buffet told us for many years that in long term mutual fund manager will screw up and the index will do better so he keeps on saying that invest in low-cost index funds. And now in India index fund for Nifty, Sensex is available and you will find Nasdaq index fund too.

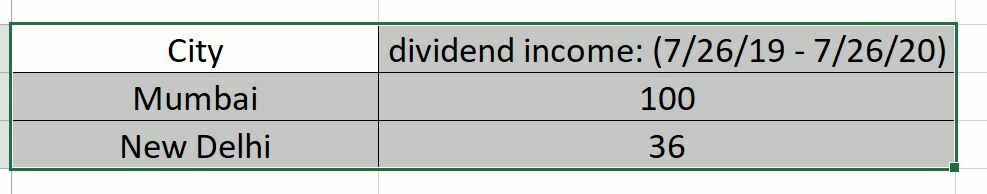

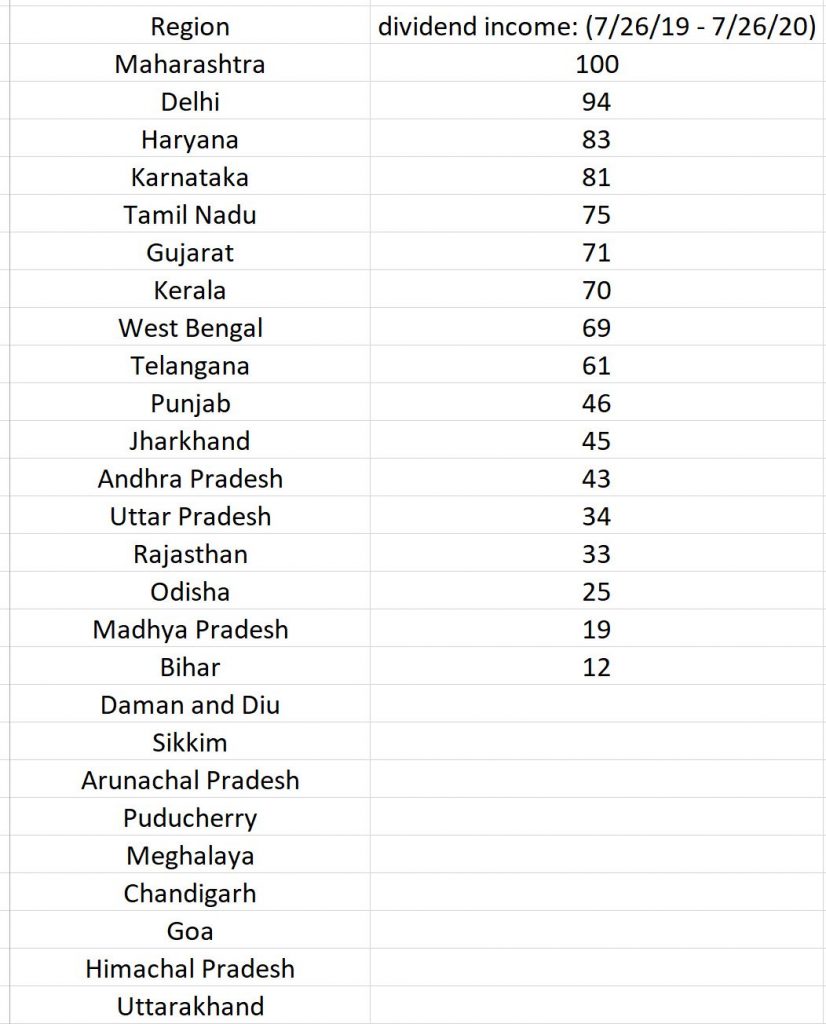

But, as I said, no one has money or patience to keep the money for the long term. Anyway, coming back to the topic. I went to Google to validate the google search history on dividend income, to check-in Indians are considering dividend income to be a legit passive income source or not. I am sorry to see that, in this low-interest environment, where your FD does not even beat inflation, even the mutual fund return in the last 5 years could not beat inflation, but people are not considering dividend investments. In a year, there are less 100 searches in most states.

As uncertainty comes back in market, in form of inflation or other economic numbers like high unemployment, high inflation, lower revenue, the speculative and growth company stocks might tumble. Because these stocks go up in low risk environment. You should consider value companies, because they have predictable income source and you will earn dividend even if the stock price drops for a while. And there are many companies which have low to no debt, which make them great investment options.

Which One Is Less Risky Dividend Yield Funds or Index Funds?

Ideally speaking none of them are that risky. While a dividend yield fund could be actively managed, hence the expense ratio could be more than a passively managed index fund. And on the same note, an index fund might not yield so much dividend in short term at least. As index funds might contain growing companies which are reinvesting in business, so the dividend pay out will be less. But, coming back to risk, ideally a dividend yield fund should contain matured companies which pay consistent dividend. And these large businesses should not be that risky to own. And as this might be actively managed, it will be on the manager to spot risk and exclude risky stocks. On the other hand index fund would be diversified across sectors and will represent an economy. I am personally focusing on dividend paying stocks, trying to build passive income stream with Dividend Earnings In India.

Why Dividend Yields Tend To Go Down Across Stocks When Market Is Bullish?

The answer is pretty simple. Say company Xyz ltd stock price is 100 rs at this point of time and last year it paid a 2rs interim dividend and 3 rs final dividend. So, at this moment the the divided yield is 5%. With me so far? Now, suddenly the market gets news that analysts have upgraded the stock from hold to buy with a target price of 200 rs per share in 12 – 16 months. In a nutshell, that is what being bullish means. Now, you see the stock price going up to 110rs a share and may be in few days it will be 150rs a share. At 100rs a share price the 5 rs dividend will give you a 5/110 *100 = 4.54% dividend yield. And it will go lower as the stock price goes higher.

Dividend Earnings In India Is Taxable

Yes, the dividend income is not tax free anymore, there will be a TDS of &% if the dividend is more than 5000 and the income is taxed per your income slab.