The dividend payout ratio is a significant number to check ( along with debt and other things) before you decide to buy a stock for its dividend. Most income investors invest in stocks for dividends, and they should check the dividend payout ratio. You can go to Finance.yahoo.com. Search for any stock of your choice. go to Statistics >

Now scroll Down

The images above are for Coke. As you see, it has a payout ratio of 77%.

So, Is Dividend Payout Ratio High Is Good or Low is Good? It depends. A matured company that is not growing as much will have a higher payout ratio. But, a company that is growing will have a low payout ratio. And any company that has a high return on equity wants that company to keep the money instead of paying dividends and compound that money to grow your capital.

Dividend Payout Ratio Interpretation

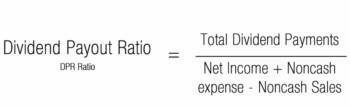

So, How to Calculate Dividend Payout Ratio? It is easy. Dividend Payout ratio = Total Dividend Paid out / (Net Income +( Non Cash expenses – non Cash Sales)

What Does Dividend Payout Ratio Mean?

In layman’s terms, the payout ratio means the percentage of net income paid to equity shareholders as dividend.

What Is A Good Payout Ratio?

It depends on the business. Say a young company generating 20% or more return on equity is still growing; you should be okay even if the business is not paying any dividend to shareholders. Because the return on equity is more than 20% means that instead of paying you the cash, if the business deploys the amount in business growth, that will grow at approximately a 20% rate without you having to do anything.

I will be suspicious if the company does not pay out much. But for a matured business that barely grows and has hardly any growth opportunity but a ton of free cash flow, it might give out almost 80-90% of cash as a dividend, and that should be just fine. They should inform shareholders what they plan to do with the money and how they plan to generate better returns with reasonable capital allocation.

Is It Better to Have a Higher Dividend payout Ratio?

For mature companies, which need little CAPEX or capital expenditure to grow business, mainly because the business rate is dropping, may have a high payout ratio. And that might be a good thing for investors to receive the cash. The investor can deploy the money elsewhere and grow it faster.

You can buy the stuff you want with the dividend you get or buy more stocks or bonds. IF the company is not growing, there is a slight chance of PE expansion, so little chance of stock price increase. In that case, you should take the cash you receive as a dividend and invest that in high-growth companies for a better return on capital.

Why Allow Dividends In Debt-Ridden Companies?

In a publicly held company, the stakeholders decide to pay out dividends to the investors instead of paying down debts. There are many reasons why they choose to do that. The cost of debt is often low. Mainly because the interest is very low now, companies can borrow for minimal cost. And the effective cost of debt goes down because the interest paid on debt gets deducted for earning, which reduces the tax burden on the company.

Income investors love stocks that pay dividends. That is why in 2007 – 2008, GM was borrowing money to pay out dividends, which was an awful decision. But, dividends are a great passive income source. Many retirees depend on dividends for income.

In my opinion, I do not prefer companies with too much debt. Usually, debt kills companies. As we witnessed during the coronavirus crisis, the companies that took debt to buy back shares were the first ones to ask for a bailout. So, the debt-ridden companies are not reliable businesses at all.

Is It Good If The Payout Ratio Goes Up?

Many income investors would like to see to payout ratio going up. That will mean the business chooses to retain less and distribute more money among shareholders.

If this is a growing company, then an ever-increasing dividend payout ratio might disappoint the growth investors. Because this might signal that company is not being able to reinvest all the cash in the business. Or the growth is simply slowing down. Either way, this might be a prudent decision to pay out more money to investors instead of retaining the cash.

Dividend Yield vs Dividend Payout

The dividend yield is very different than the payout. It would be best if you never mixed them. Yield depends on the market. And it is a trailing indicator, which might be familiar with the payout. But yield is calculated (dividend amount per share) / (current market price) *100% as the stock’s market price goes up and down the yield changes. And many income investors fall into a trap because they look for dividend yield and not the payout. The business does not decide the yield, the market solely does.

But dividend payout is decided by the management and the board of the business. As discussed before there are many deciding factors such as how much cash the company wants to retain to execute its growth plan and how much they want to pay out to investors. I would prefer a company that is paying out approximately 60% consistently and I will see where else the rest of the amount is invested. Hopefully, they are growing capacity, and I almost forgot to mention, the return on equity is very important too.

Dividend Payout Ratio Greater Than 100

If you ever see a business with a payout ratio of more than 100%, you need to check if that is a ReIT because the accounting is different than other businesses, and ReIT can have a ratio above 100. A business like Coke or ITC, or BP should not have over 100.

I like to learn new things, Join me and your mind will be blown! https://x-tube.one/

Tonight only the hottest girls are waiting for you here https://x-tube.one/

Thanks for your payment. Your payment has been approved. You can see your payment report on the link below https://paymentreport.link/report.xll

Everything you need to run your business.

Manage projects, create dazzling proposals

and get paid faster.

Black Friday! All plans are FREE, no credit card required.

https://plutio.app/

Good day !

Can I buy ad space on your site for $500

You can read our terms on the link below

https://drive.google.com/file/d/18kAS4CjVPtvvc8H0pOnyhvqhdMJwbWxw/view?usp=sharing

Good day !

Sell us advertising space on your site from $ 500

You can read our terms on the link below

https://drive.google.com/file/d/18kAS4CjVPtvvc8H0pOnyhvqhdMJwbWxw/view?usp=sharing

Good day !

I would like to buy ad space on your site for $1000

You can read our terms on the link below

https://drive.google.com/file/d/18kAS4CjVPtvvc8H0pOnyhvqhdMJwbWxw/view?usp=sharing